‘What Your CD Really Means — In Plain English’

PUBLISHED October 28, 2025

✅ Understanding the Closing Disclosure (CD) – Especially With a No-Cost Loan

A MortgageMarketMentor™ educational guide

(refer to the sample Closing Disclosure at the bottom)

If you recently bought a home or refinanced, you received a Closing Disclosure — also called a CD.

For most people, it’s one of the most confusing documents in the entire loan process. Even experienced homeowners often ask:

- “Why does the CD show fees if my loan was No-Cost?”

- “What do all these sections mean?”

- “Why do I see a loan broker fee in one place, but a credit somewhere else?”

As a licensed Loan Broker with over 25 years in the business, I agree — it should be clearer. So here’s a simple, plain-English breakdown that anyone can understand.

✅ Why the CD Exists

The CD replaced the older HUD-1 Settlement Statement in 2015 under new rules from the Consumer Financial Protection Bureau (CFPB). The goal was transparency — but the new format still confuses homeowners and even some professionals.

✅ The Most Common Misunderstanding:

“If I got a No-Cost Loan, why are there thousands in fees on my CD?”

Great question — and the answer is straightforward:

✅ The CD always lists real fees involved in getting the loan.

✅ But on a No-Cost Loan, those fees are covered by the lender, not you.

✅ The lender credit doesn’t always appear in one clean line — it’s often spread across different sections of the CD.

So the fees show up on paper, but the key is who actually paid them.

✅ Breaking Down the CD (In Plain English)

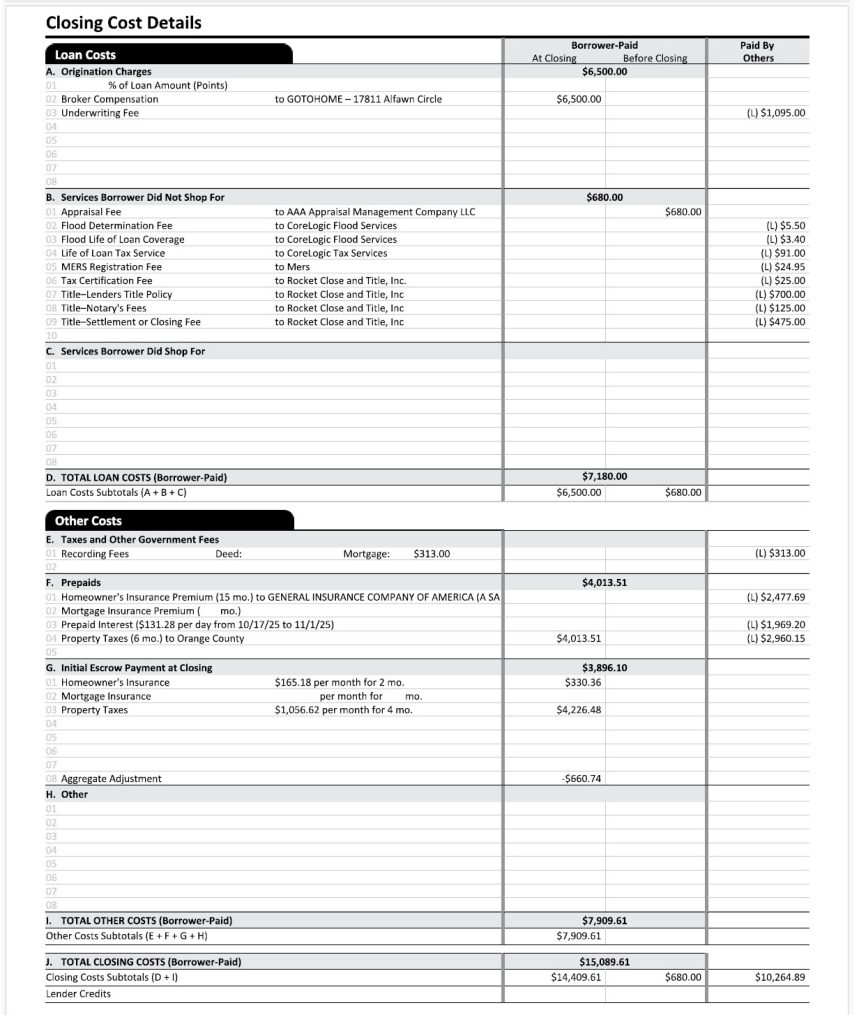

✅ 1. Sections A–D: Loan Fees

This is the section most people jump to first.

It includes things like:

- Underwriting and processing fees

- Title and escrow fees

- Appraisal fees

- Loan Broker Compensation

✅ Your Loan Broker Compensation

This part can vary:

✔ Sometimes the broker fee is paid by the lender.

✔ Sometimes the broker fee is paid by the borrower.

✔ Both are perfectly normal — it simply depends on how the loan was structured.

If it’s paid by the lender, you’ll usually see it listed as “Paid by Others” with an (L) for Lender Credit.

If it’s paid by you, it will appear under “Borrower-Paid.”

No matter who pays it, this section shows the true cost of originating and closing your loan.

✅ 2. “Borrower-Paid” vs. “Paid By Others”

Every fee on the CD will have two columns:

- Borrower-Paid (meaning you paid it)

- Paid by Others (meaning the lender or another party covered it)

When a loan is No-Cost, most (or all) of these items will appear in the Paid by Others column, and often marked with (L) — which stands for Lender Credit.

That means the lender absorbed that fee for you.

✅ 3. Sections F–G: Not Loan Fees

This is where the confusion really starts.

These items are not loan charges:

✔ Property taxes

✔ Homeowners insurance

✔ Prepaid interest

✔ Escrow (impound) reserves

These are normal homeownership expenses you would pay whether you are purchasing a home or refinancing one.

The only difference is when they’re collected:

✅ On a purchase, these items are collected for the first time to set up your new impound account.

✅ On a refinance, they are adjusted or replenished to keep your existing impound account funded under the new loan.

Either way, they’re not loan fees — they’re simply part of homeownership.

And if your lender credit covers these items, you’re not paying them out of pocket.

✅ 4. When the Broker Fee Is Paid by You

This part surprises many borrowers:

✔ If your Loan Broker Fee (also known as points) is listed as Borrower-Paid,

✔ The lender cannot apply a “Lender Credit” directly to offset that specific broker fee.

✔ That’s a compliance rule set by federal lending regulations.

But here’s the key:

Even though the lender can’t credit that broker fee line directly, you may still not pay it.

In a No-Cost or Low-Cost Loan, when the broker fee appears as “Borrower-Paid,” the lender will often credit other non-loan-related costs to achieve the same result — a true no-cost transaction.

Instead of showing the credit on the broker fee line, the lender applies it toward:

✅ Property taxes

✅ Homeowners insurance

✅ Mortgage interest due through the end of the month

✅ Escrow account setup or reserves

So even though the CD doesn’t show a direct credit next to the broker fee, the lender still covers that cost by paying for these other items.

The total lender credit still equals — or exceeds — the total costs you would have paid.

✅ Bottom line: You’re still getting a No-Cost Loan.

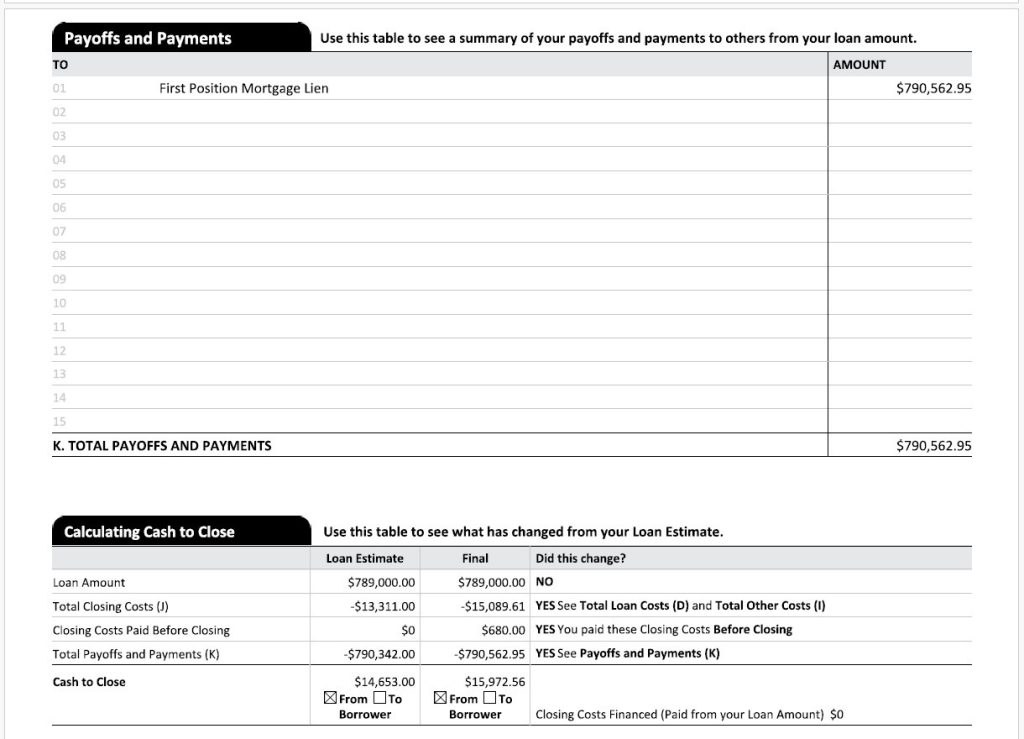

✅ Real-World Example (The CD Shown Above)

- Total Loan Fees: $10,037.00

- Total Lender Credit: $10,264.89

- Net Credit Back to Borrower: $227.04

✔ All loan costs were paid by the lender

✔ The borrower paid $0 out of pocket

✔ The borrower even received a small surplus credit

That’s what a true No-Cost Loan looks like on a Closing Disclosure.

✅ Bottom Line

- The CD will always list fees — even on a No-Cost loan.

- The key is who actually paid them.

- If the lender credits cover those fees, you did not pay them.

- Even if your broker fee shows as “Borrower-Paid,” the lender can still offset that by covering other costs like taxes or insurance.

- You can always ask your broker to review your CD — even months or years later.

✅ About MortgageMarketMentor™

This educational article is part of MortgageMarketMentor™ on GoToHome.com, California’s platform connecting homebuyers with:

✅ The 3 best Realtors in each California city

✅ The 3 best Loan Professionals in each city

✅ Real guidance — not sales pitches

If you, a friend, or family member is buying, selling, or refinancing, visit GoToHome.com for trusted help from proven experts.